The engagement process we are undertaking with hui, email, social media, surveys and our website is designed to offer our owners the opportunity to ask questions and to be fully informed of the various options we are considering as well as to offer transparency and accountability. We were very pleased to get this comprehensive set of questions and we have spent quite a bit of time putting together the answers. We hope this post will also answer some of your questions. We value your input and encourage your participation.

Here are the questions with responses from the Trust.

I would firstly like to commend Uenuku Fairhall’s presentation of the cultural and historical significance of the block and surrounding It was excellent. I found it of considerable interest and also found his comments on the past present and future thought provoking.

Issues arising from the information available to date which I would like dealt with at the forthcoming meeting

– A copy of the latest financials

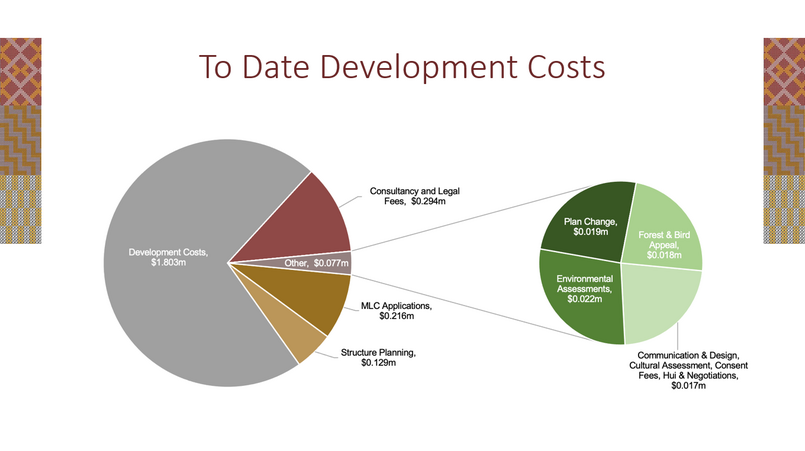

Please see the Costs to Date slide below from the Hui No 3 presentation. The financials were provided at the 2020 General Meeting and can be sent out to you.

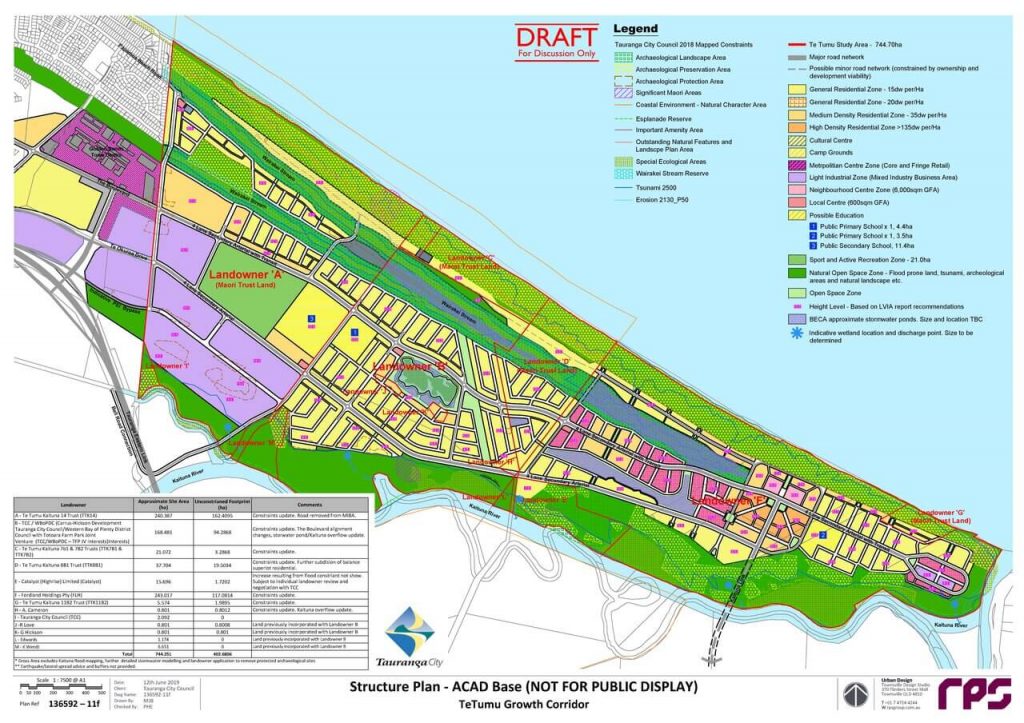

- The Draft Structure Plan of the development of the block , forming part of the slides given at both huis.

Here is the Draft Structure Plan used in the presentations.

Reference was made by Leo that other land blocks in this plan were identifiable. They weren’t

Here is the Landowner Map:

The 7 main landowner groups within the Te Tumu Strategic Planning Study area are as below, noting there are other smaller land blocks within the growth area – being 14 landowner areas in total (refer Attachment A – Part 3 for identification of landowner block identification):

Owner:

- Site 1 – Tumu Kaituna 14 Trust

- Site 2 – Tumu Kaituna 7B1

- Site 3 – Tumu Kaituna 7B2

- Site 4 – Tauranga City Council/Western Bay of Plenty District Council (Carrus/Hickson Development Interests)

- Site 9 – Tumu Kaituna 8B1

- Site 10 – Catalyst (Highrise) Ltd

- Site 11 – Ford Land Holdings

- Site 12 – Tumu Kaituna 11B2

- Site 14 – Tumu Kaituna 16

The majority of the land holdings in the Te Tumu Strategic Planning Study area are large, although there a small number of more fragmented blocks throughout the area. 87.4% of the land area is owned by three parties:

• Tumu Kaituna 14 Trust – 240ha

• Tauranga City Council/Western Bay of Plenty District Council (Carrus/Hickson Development Interests)) – 170ha

• Ford Land Holdings/Properties – 243ha

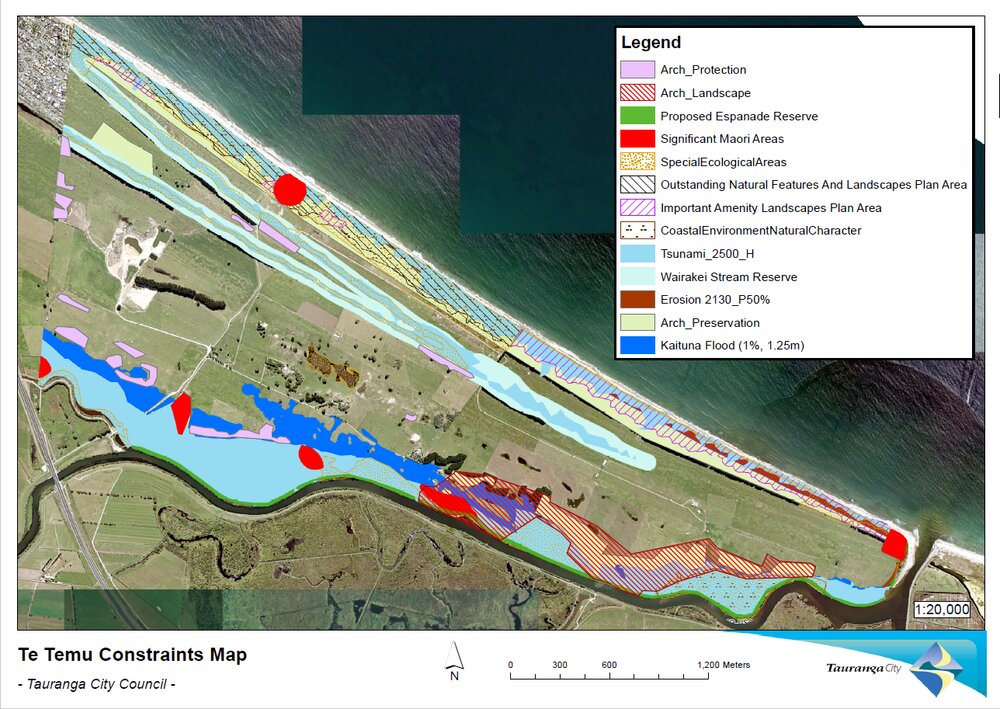

We were advised that work had been completed on land constraints, natural hazards etc. Is this information available? Are there visuals ?

Here is the Land Constraints Map.

Current Land Use

Please advise if the land is currently leased or is being run by the trust as a farm.

The land is being maintained by the Trust through casual grazing that is offset by fencing, maintenance and security alongside the Sand Mining Agreement with Stevenson Aggregates which further rehabilitates the land.

I seem to remember that in a meeting a few years ago the land was being leased for quite a low amount to a current trustee.

Trustees have not leased the land.

However in your recent comments it was inferred that you were managing this as a farm on behalf of the owners The term “farm” would be very liberal use of that word given the nature of the land. If we had the financials we could see what the case is. A recent view of the land block was not impressive even with the understanding that there are challenges at that location. Certainly compared to the neighbouring block.

As above, these can be provided to you.

The Proposed Development

Urban development does seem to offer a way forward to generate a sustainable income for the future and by leasing the land it does offer more assurance in being able to retain the ownership of the land for future generations.

I have a concern that there does not seem to be a cost benefit analysis for this proposal. There should at least have been a basic analysis prior to the $2.5 Million already invested.

The Trustees have responsibility to manage the land and are satisfied that all expenditure incurred is warranted to protect the interests of the Trust and pursue opportunities for development of the land that is in the best interests of the majority of owners. With 5500 owners on the register, it is acknowledged that there will always be some owners that take a different view to the majority. The financial scale of development on the land is very significant.

By comparison residential land (unsubdivided, general title) is currently selling for $3.0m+/ha. There is approximately 38.0ha (net) of residential land in the block which if it was in general title would be worth $114.0m. With average develop costs this would yield very conservatively $494.0m.

A very conservative ground rental of 3% would yield approx $14.82m per annum.

As the Trust has committed to retention of Maori Freehold Land status the value creation must be approached in a different manner.

We are being asked to agree to a development that would cost us $80 million. Can we have a breakdown of these costs?

Approximate High Level TK14 Proportion of Infrastructure Costs

| Infrastructure | Council Funded Network Infrastructure & Recovered through Development Contributions

(Mainly Infrastructure External to Te Tumu Growth Area to Service Te Tumu) |

Internal Vested Infrastructure (Within TK14)

|

| Water Supply | $11,000,000 | $3,000,000 |

| Wastewater | $34,000,000 | $3,000,000 |

| Stormwater | $5,800,000 | $7,000,000 |

| Transportation | $8,000,000 | $8,200,000 |

| Total | $58,800,000 | $21,200,000 |

We have been told the development will be phased. Details are required . We need to know some idea of the stages to this development.

The first stage could likely involve up to 100 residential dwellings constructed with access off the end of Papamoa Beach Road. Following that development could be staged off the two collector Roads which are likely to be phased with the northern road being constructed first which will open up the residential land on the block (up to 1,400 dwellings). Upon the southern road being constructed the commercial land could commence development; at present this is seen starting approx 5 -10 years after the northern road is constructed.

Leased land would suit certain types of land use rather than others. Has there been any adjustment to the proposed structure given this Seems to be exactly as presented some years ago.

The Trustees propose to have land zonings that provide a variety of land lease income streams with 53ha (net) of Commercial Land that would provide both land and building rental income; while the 38ha of residential land would provide land rental income as would the proposed 20ha Active Reserve and 10ha School Site.

On the limited vision of the plan available and from comments made it seems that there will be a limited area available for us to lease.

There is approximately 38.0ha (net) of residential land that would provide for a variety of housing opportunities for owners. See slides 21 – 27 in the hui #3 presentation.

Will the return justify this expenditure under the current plan particularly as you have stated that you are going to offer subsidised housing and subsidised commercial use for beneficiaries (subsidised land lease, low interest loans mentoring etc)

The Trustees are seeking feasiblility funding to engage expert analysis on the outcomes of the proposed plan.

At a high level a very conservative ground rental of 3% would on the residential land will yield approx $14.82m per annum; this allows for a variety of potential subsidies to be provided. A very conservative ground rental of 5% on the commercial land will yield $18.550m per annum.

Current Designated Land Use

Based on the plan given we seem to have been apportioned the area for smaller sections with more intensive population density. This will require a far greater amount of infrastructure such as roading which will increase the cost to us as developers. This is already clearly noticeable in some areas of Eastern Papamoa. It is also of lower value in economic terms. I query the value of return on investment compared to the other land use types.

Plans for our block must also fit with the overall plan for the Te Tumu area and meet planning rules and public consultation at a later date.

The infrastructure costs are based on higher residential densities; similar to those being developed in Papamoa East eg General Residential between 15-20dw/ha and medium density of 35dw/ha. For general title land residential development is the highest and best use; with the highest returns currently being for densities between 20-25dw/ha. This does not necessarily hold for Maori Freehold Land and the aspirations of the Trust. This needs to be investigated further

Developers are required to ensure a percentage of the land is used for parks and reserves. We do seem to have a disproportionately large amount allocated for these purposes. Are the other blocks also setting aside the required amount of land or are we offsetting their requirements. If so we need to have financial remuneration for this.

Each landowner has to provide Neighbourhood Reserves for their own developments based on population and land area. The TK14 has the least amount of constrained land of the three main landowners being 35% compared to 44% and 50%. TK14 is providing the 20ha Active Reserve which they will be compensated for by either a land lease or exchange of interest (ownership is retained by TK14) for TCC surplus land (see Hui No3 presentation). Subject to negotiations it is feasible to obtain lump sum cash in advance for the active reserve that would give the Trust equity to advance other leasehold objectives.

Beneficiary Training and Employment

Having a link to the trade skills is excellent but we need to go further. I would strongly recommend that there is a greater link to varied employment sectors. This development will include business management, infrastructure development with large scale industry , town planning with TCC etc. These avenues should be explored with tertiary education support and holiday work programmes as is offered elsewhere.

Agreed these are great initiatives to be explored and developed as the planning for the development progresses. Unless we can get to the starting line with the ability to develop our lands (ie. Infrastructure to our land, zoning) these aspirations become somewhat academic.

Phased development/ Alternatives

Why not limit our financial involvement?

The Trustees are exploring all available capital funding sources that are available to minimise financial involvement. These include applications to the Whai Kāinga Whai Oranga, the $730m fund to provide to support and enable Māori-led housing solutions; as well as iniatives lead by Kāinga Ora as noted in the hui presentations. There are excellent templates of this occurring nearby.

An initial Joint Venture leasing for a Retirement Village, one of the biggest growth industries in a highly sought after area. This would offer a significant return with a more limited financial obligation. This could be developed within a reasonable time frame enabling us to develop a greater financial cushion to then progress in other areas. This can be the source of income to build homes for rental purposes. This could then lead to sufficient income to build papakainga, or rent to buy for our beneficiaries. Yes you mentioned the recent funding initiatives of the government and how we could use them in this project. But these are recent.

A Retirement Village concept is a good idea to explore as part of the planning for the development; the key to this is enabling the network infrastructure to be provided through the infrastructure corridors and in turn getting the land rezoned.

What had you planned prior to this. Or did you have no plans?

The Trustees plans were to develop housing for owners as well as developing commercial land for long term income streams.

I query the lack of real detail in much of your presentation given the time taken to develop this proposal and the amount already committed to this project

Hopefully the information above assists with this concern.

Financial and Legal Implications

As the owners of the proposed leasehold land will we be held liable for damage as a result of major climatic events, other natural events etc?

The infrastructure providers carry the liability for their own infrastructure both in and above the ground; this is covered by their own insurance; in addition to maintenance obligations this is a reason that it is preferred that the infrastructure is owned or vested to infrastructure providers e.g. Council, Powerco, Tuatahi First Fibre. The buildings, infrastructure and structures on the land will be insured by the building owners. The Earthquake Commission also provides insurance to home owners for natural disaster events; this needs to be complimented by private homeowner insurance.

Trust Elections

Where are the bios on the current trustees?

These are being posted on the website shortly.

What has each Trustee been involved in with our block in the past and what has been their role in this development project?

The Trustees have worked together as a united team over a long term (32 years) including Trustees who are no longer with us. When the time comes each Trustee will speak for themselves.

Why did so few speak to any level of significance at the huis?

The Trustees had previously chosen to speak through the Chair as the primary spokesperson for the Trust to ensure a clear and accurate message is delivered. In response to requests by some owners the Trustees have decided to share the presentation workload through the engagement hui but the Chair remains the official spokesperson for the Trust.

We are told we need to retain some of the current trustees to ensure the project continues in a timely manner but it is hard to see why unless we know their current involvement. The pause when no trustee would speak about the proposed elections format was palpable. And telling.

The Trustees take a different view on that comment – the engagement hui are about stimulating conversations and inviting feedback from owners. Accepted that everyone is having to work in an environment they are not familiar with (Zoom) but comments and overall feedback has been constructive and will lead to positive progress.

We each have reasons to elect a person to serve as Trustee. In Hui 1 we were told that the recommendation would be for potential trustees to be university educated or experienced business people. In Hui 2 you refined it to state that they must have 10 years experience in Maori governance or have a tertiary qualification in Maori Land administration or similar. I find any of these concepts questionable. Why are these the requirements when they don’t exist elsewhere?

The initial policy was a conversation starter with precedents taken from other successful Trusts. If development of the Trust proceeds the Trustees will be kaitiaki of assets eventually worth hundreds of millions of dollars. Owners need to have confidence that the Trustees have a level of capability that matches the responsibilities of being a Trustee. Owners will have varied opinions on what they see as suitable criteria for Trustees.

The Trustees have taken on board the feedback received and have put forward an amended Trustee Election and Rotation Policy at Hui No 3. Ultimately it is the responsibility of the Maori Land Court to appoint Trustees and they will also consider the skills and experience of Trustees nominated for appointment, as per the Court’s nomination form.

A university education is not indicative of anything other than an ability to think in a certain way, or an applied knowledge such as engineering, forestry or whatever. I’m sure we have had experience of trustees with these backgrounds and some have been superb but not all. I’m sure we also have experience of trustees who have been involved for many years. Some are superb, but not all.

A background in business… I can think of altruistic community minded people with business acumen ….and then those who are self serving. Yes this is a huge financial commitment and we will need people who will be able to guide us well and protect our interests in the best possible way. I can think of young and old, forward thinking proactive people, of both genders. In other words there is no one set of agreed skills and traits that make a successful trustee and different trustees bring different strengths. We need integrity, we need trustees who are positively proactive, to represent us, to move forward in the best way possible.

We each have reasons to elect a person to serve as Trustee We do not want to be constrained by a trustee having to fill a certain mould. We all know our way of elections is not perfect. We all know situations that are not ideal We all know that at times a small pocket of owners can dominate an election. But we have to assume that we will make informed decisions based on the information given us for those who are prepared to stand.

We now need to build on this base and move forward in a positive way for the sustainability of our land for our future generations.

We would like to thank this owner for the questions and for the mahi and the thought put into them. As Trustees, we hope we have been able to provide clarity on these points. If you have questions or comments you can complete a survey here or email us at info@tumukaituna14.org.nz or you can visit our Facebook page.